To-do lists are everywhere, but most people don’t use them effectively. Instead of helping, they often turn into endless, guilt-inducing lists of unchecked tasks. After plenty of trial and error, I’ve figured out a system that actually works. And today, I’m sharing it with you.

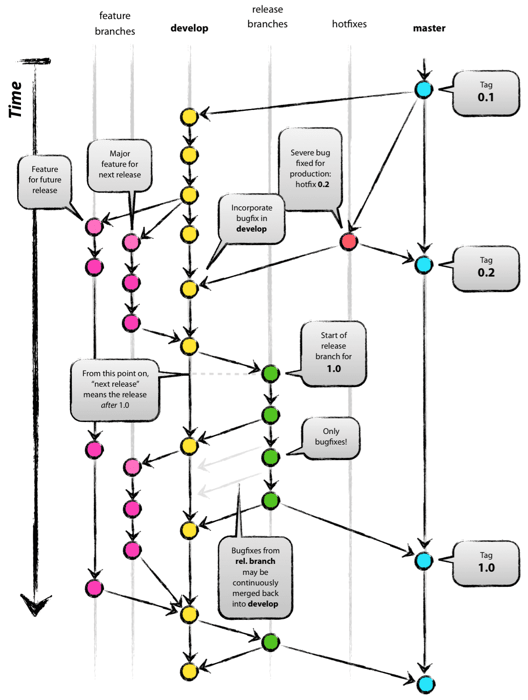

My 6-Box To-Do List Template

First, let me introduce you to the secret weapon that keeps me organized: the 6-Box To-Do List template I created myself. I use this every day on my iPad with the Goodnotes app (which, by the way, is free). Here’s how it works:

At the top, I write the date and day of the week (I usually create pages for the entire week at once). The template itself is a simple 2x3 table that divides my tasks into Home and Work categories. Each category is further split into three types: Must, Ideal, and Must NOT.

Here’s the breakdown:

Must: This is the non-negotiable stuff. Things I absolutely have to do today or tasks I’m highly motivated to complete. The key is to prioritize. Keep this list short and focus on crossing off at least 80% of it.

Ideal: These are my “bonus” tasks. I’d like to get them done, but if I don’t, no big deal. It’s like the dessert of my productivity day—nice to have, but not essential.

Must NOT: This is where things get interesting. This box is my reminder of what NOT to do today. It could include:

Tasks that aren’t worth my time (hello, endless scrolling through YouTube shorts).

Things I’m intentionally pushing to another day because they’re too time-intensive or require more focus than I’ve got for the day.

Writing these down is like decluttering my brain. It’s a mental unload that helps me stay focused and stress-free.

My To-Do List Principles

Having a great template is only half the battle. Here are some key principles I follow to make sure my To-Do List works for me, not against me:

The 5-Minute Rule: If a task takes 5 minutes or less, just do it now. Don’t waste time writing it down. The exception? If you have a bunch of quick tasks to remember, jot them all down together before they skip your brain.

Keep the Must Box Manageable: Overloading this box is a surefire way to set yourself up for failure. If you’re constantly carrying tasks over to the next day, it’s time to re-evaluate and preload tasks to future days.

Separate Repeating Tasks: Daily habits (like drinking water or checking email) don’t belong on your To-Do List. Use a habit tracker or a different tool for those. I’ll dive deeper into this in a future blog post.

Start Your Day with a Plan: Creating or finalizing your To-Do List first thing in the morning is a great way to plan the day. It sets the tone, helps you prioritize, and ensures you’re clear on your goals right from the start.

A Few Touchups in Goodnotes

- Stamps: Sometimes, I like to spice up my To-Do List with digital stamps, marking tasks as either Important (stuff that might get me in trouble if I skip) or Happy (tasks that bring me joy when completed). These items are more likely to get done.

- Highlighter: When I complete a task, I use the highlighter tool to mark it. There’s something immensely satisfying about seeing those colorful highlights at the end of the day. It’s like a visual trophy case of your productivity, and reviewing the list becomes a moment of pride instead of stress.

- Cut/Paste: One of the reasons I love using Goodnotes for my To-Do List is how easy it is to move tasks around. Didn’t finish something today? Drag it to tomorrow. Priorities shifted? Rearrange your boxes without rewriting a thing.

Final Thoughts: Less Stress, More Success

A good To-Do List isn’t about cramming as much as possible into your day. It’s about focusing on what matters, staying organized, and giving yourself the mental space to actually enjoy crossing things off. With the 6-Box method, I hope you feel more in control.

So give it a try, and let me know how it goes in the comments.

Picture of The Day

— Dr. Tree (@lannyland.com) January 11, 2025 at 9:02 PM

P.S. Remember, the easiest way to keep up with my journey is by visiting blog.lannyland.com